Yesterday’s brutal sell-off may have left traders reeling, but today’s price action is hinting at a notable shift. There’s no major economic data on deck this morning, and notably, there’s been no tariff-related relief either. Yet markets are staging a significant overnight bounce — a signal worth paying close attention to.

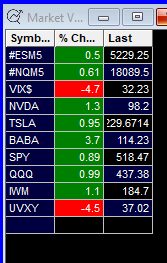

Here’s what’s happening as of 8:27 AM EST:

Markets are now trading back inside the opening range of Friday’s session, essentially erasing the previous day’s sharp losses. This rebound has come without any major headlines — which makes it even more critical to pay attention to price action today.

No Major Economic Data, but Eyes on Earnings

There are no key macro releases today. However, Tesla earnings are after the bell — and that could kick off earnings season volatility. Expect positioning to be cautious into the afternoon.

Price Action & Key Technical Levels

Friday’s pre-market breakdown zones have now turned into potential resistance. As we’re back inside that range, watch for reactions at these inflection points:

SPY: Needs to reclaim and hold above 520–522 range to continue the upside.

QQQ: Eyes on the 434–437 zone for a clean break and possible retest of 440.

ES: Watching the 5280–5310 area to see if it can hold as intraday support.

Despite the rebound, volatility is still elevated. UVXY and VIX are cooling off, but they’re not completely out of the danger zone. This isn’t yet a low-volatility uptrend — it’s a bounce in a high-volatility environment.

Game Plan

Today’s focus is on two key ideas:

1. Reclaim + Continuation If the market can hold pre-market gains through the first hour and consolidate above VWAP, we’ll look for continuation long plays. Volume confirmation is critical.

2. Fakeout & Fade If price stalls or breaks below VWAP post-9:45 AM, we’ll treat this as a relief rally with a possible fade opportunity. Use the SPY/QQQ levels above for directional clues.

Use yesterday’s April 21st Game Plan to guide your key levels and zones. Today’s bounce brings those back into play.

Want to trade this live with structure?

Join my Live Edge Group and get a $29 one-week risk-free trial. See how we plan, execute, and adapt in real time. → Join the 30‑Day Fast‑Track Program – Join Now

Let’s trade smart. See you in the room.

—Shawn

Disclosure

The information provided in this article is for educational purposes only and should not be considered as financial advice. Trading and investing in financial markets involve substantial risk, and it is important to conduct your own research and consult with a qualified financial professional before making any investment decisions. The author is not responsible for any financial losses or gains that may result from actions

Trading futures, stocks, and options involves significant risk and is not suitable for all investors. This content is for educational purposes only and does not constitute financial advice.