Live Trade Analysis – March 14th (Breakout & Failure Case Study)

Trade execution, key observations and lesson learned

Trade Context & Initial Setup

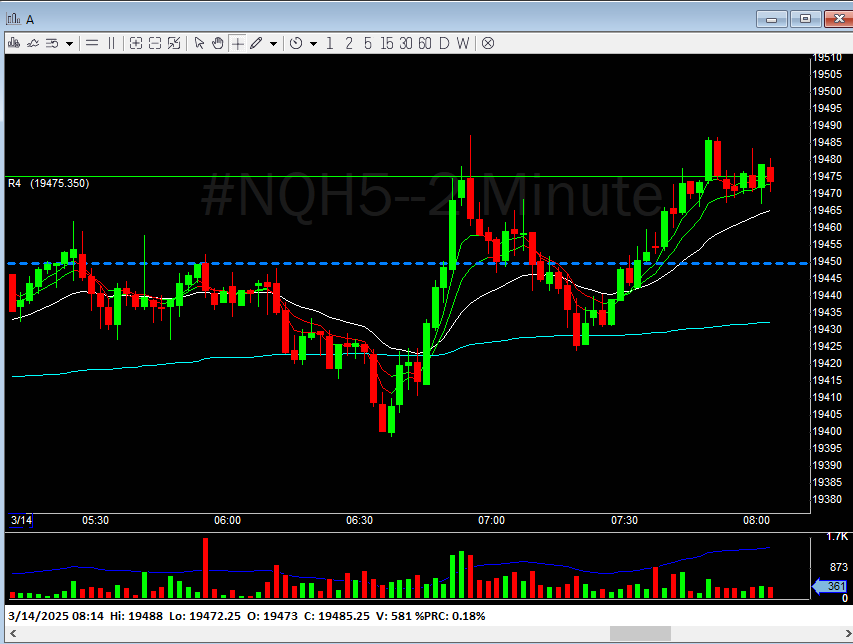

On Friday, March 14th, after four consecutive red weeks, the market showed signs of a potential relief bounce as EVIX was dropping. Both SPY (+0.92%) and QQQ (+1.92%) were up, indicating bullish sentiment, but NQ futures lagged at just +0.15%. This created a cautious but opportunistic environment for a possible breakout trade.

Key Pre-Market Observations:

NQ was trading near pre-market highs and the R4 pivot level.

ES was below pre-market low, meaning it was lagging slightly.

A significant buy injection at 7 AM had supported price at the same level earlier.

The market was consolidating rather than selling off, a potential sign of coiling momentum.

1. Trade Execution: Long on NQ 19490 Breakout Attempt

Reasoning for Entry:

Keep reading with a 7-day free trial

Subscribe to SMART TRADERS CAPITAL to keep reading this post and get 7 days of free access to the full post archives.