The Myth of Speed: Why Multiple Funded Accounts and Copier Strategies Undermine Your Success

Before You Chase That Flash Sale, Let’s Map Out Real Growth

Hey, let’s sit down and unpack a common squeeze traders face: those flashy promos—“35% off fast payouts! Use code ‘SPRING’ before midnight!”—and the urge to open more accounts or plug into trade-copier software. Sure, they feel exciting, but here’s how to flip that marketing hype into a real plan for solid progress.

1. The “Flash Sale” Tease: Marketing 101

You scroll your feed and boom—“No more payout windows. Just fast payouts! 🔥 35% OFF FLASH SALE 🔥”

It’s designed for one thing: impulse. You think, “If I don’t act now, I’m missing out!”

What you gain: A fee discount if you’re truly ready to launch a new account.

What you risk: Splitting your focus when you haven’t yet mastered the two you already run.

Pro tip: Pin the deal to the back burner. Use that extra cash only after you’ve locked in consistency on your current accounts.

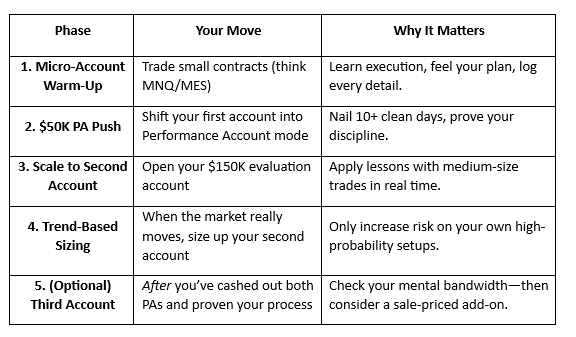

2. Phase-By-Phase Roadmap: Two Accounts, One Focus

3. The Copier Conundrum: Amplified Trades, Amplified Emotions

Copier software sounds like a dream: place one trade, and it automatically shows up in all your linked accounts. No more clicking over and over—what’s not to love?

But here’s the catch: every winner is a bigger winner… and every loser is a bigger loser, too.

Sudden shock: A small drawdown in one account turns into a gut-punch across all of them.

Emotional overload: Watching a losing trade multiply triggers a stress response fast—heart racing, thoughts spinning, self-doubt creeping in.

Loss of control: You’re no longer focused on your entry and exit rules; you’re glued to P&L, wondering “How bad will it get?”

Ask yourself: if a single trade goes against you, are you ready to absorb that hit times three? That amplified pain often leads to revenge trading or abandoning your plan altogether.

Better approach: Trade each account on its own merits. Start small, learn your edge, and build confidence one setup at a time. Let profits and losses teach you—don’t let software shortcuts steal your lessons.

4. Keep It Simple: Your Next Moves

You’ve got two strong accounts building momentum. Here’s how to stay focused and avoid chaos:

Start a 10-Day Journal

Log: Daily P&L (even small wins count), how you felt (focused or frazzled), and whether you ticked off your pre-trade checklist.

Why: Seeing real progress on paper keeps you honest and highlights when you need a break.

Celebrate the Little Wins

Took profit exactly at your target?

Walked away after a stop instead of revenge trading?

Stuck to your max-loss rule without hesitation?

These moments build the muscle of discipline that turns into consistent results.

Mute the Noise

Turn off buzzy flash-sale emails and copier alerts.

Remove one-click links to new programs.

Fewer distractions mean more brainpower for your actual trading plan.

Mark Your Payout Milestone

Circle early May on your calendar for that first $50K PA withdrawal.

Visualize clicking “Withdraw”—use it as daily fuel for keeping clean trading days.

5. Remember Why You Started: A Performance-Based Profession

At its core, trading is a performance-based profession. Your focus must be on three things:

Identifying the right setups—spot the market conditions that match your edge.

Execution focus—nail your entry and manage your trade without hesitation.

Clean exits—take profits or stops exactly as planned.

Take care of these, and everything else—profits, account growth, equity curve improvement—naturally follows. But when you shift your attention away from process and onto amplified P&L via copier software, you invite behavioral slippage: stress-driven mistakes, overtrading, and second-guessing. Keep your mind on setups, execution, and exits. The money will take care of itself.

Your real edge isn’t in chasing every promo or automating across half a dozen accounts. It’s in honing your process, one trade at a time, with clear focus and emotional control. Stick with your two accounts, master them, and only then consider adding more tools or deals. That’s how good traders grow—slowly, surely, and on their own terms

—Shawn

Disclosure

The information provided in this article is for educational purposes only and should not be considered as financial advice. Trading and investing in financial markets involve substantial risk, and it is important to conduct your own research and consult with a qualified financial professional before making any investment decisions. The author is not responsible for any financial losses or gains that may result from actions

Trading futures, stocks, and options involves significant risk and is not suitable for all investors. This content is for educational purposes only and does not constitute financial advice.